Global investing offers financial rewards and unique opportunities for diverse investors. As suggested by Rani Jarkas, the Chairman of Cedrus Group, from portfolio diversification to gaining an edge on exchange rates, there are a number of potential gains that can be had when taking one’s investing strategy global. With the right advice and a careful approach, investors can unlock the power of global investment and open up new avenues for profits.

1 Leverage the Globe

Making the move from domestic investment within one’s country to global investing can open up a new world of opportunities. Investment advisor Rani Jarkas recommends that clients develop a solid understanding of the markets outside their comfort zone, as this will help them make informed decisions to capitalize on global trends.

1.1 Make Connections

The importance of developing relationships with global networks cannot be overstated. It is especially important to engage with experts in different countries and regions, as they will be best positioned to help investors capitalize on changes in the markets and emerging trends.

1.2 Open Doors to Growth

Opening doors to international investors can unlock a new market of potential clients. Establishing a presence in markets outside of one’s own and creating an online presence to reach potential customers can boost customer acquisition and provide an opportunity for higher profits.

2 Navigate New Markets

The success of global investments often depends on knowing how to navigate new markets. This includes becoming familiar with the investment landscape and understanding the rules, regulations and taxation laws in other countries.

2.1 Spot Opportunity

Navigating ne;w markets can open up opportunities that are simply not available at home. In the case of a Hong Kong-based investor, taking advantage of the liberal, investment climate in Singapore might be the perfect way to diversify the investor’s portfolio.

2.2 Fund the Future

Navigating new markets can also lead to significant returns if done right. By paying attention to market trends and researching new opportunities, investors can identify new investment vehicles to diversify their portfolio and fund their business activities.

3 Grow Across Borders

Making investments in other cou ntries can help investors diversify their portfolio, take advantage of different economic cycles, and maximize returns. By taking a global approach, investors are better positioned to identify new opportunities and mana;ge their risk.

3.1 Open New Accounts

Opening new accounts in different countries can open up a variety of investment opportunities. For example, it can allow investors to access capital markets that are unavailable in their homeland, and access preferential exchange rates.

3.2 Spread Your Wealth

Spreading investments across different countries can increase diversification and help to manage risk throughout the portfolio. For example, by investing in a variety of different countries, investors may be able to reduce volatility, capitalise on currency fluctuations, and make strategic financial decisions.

3.3 Capitalize on Change

From changes in government policies to currency fluctuations, taking advantage of change in global markets can have a major impact on an investors’ bottom line. It is important to understand the effect of these changes and how to best capitalize on them.

4 Broaden Horizons

Opening doors to investment op portunities in other countries can help investors broaden their horizons and investigate the potential of new markets. It can also give investors a new perspective on their long-term strategies and improve their financial manage;ment skills.

4.1 Unleash Your Resources

By leveraging resources in global markets, investors increase their chances of success and may be able to capitalise on unique opportunities that are not available in their domestic market. For example, investing in emerging markets can provide access to higher yields.

4.2 Choose Wisely

Choosing wisely when it comes to investments is essential. Investors should consider not only the potential rew;ards of their investments, but also the risks, costs and tax implications of inv,esting in different countries to ensure they make informe d decisions.

5 Exploit Exchange Rates

Exploiting excha nge rates to your advantage can have a significant impact on profits. Making smart moves can help investors capitalize on signficant gains, but this should be done carefully and with an in-depth understandng of the markets.

5.1 Gain an Advantage

Understanding the complex nature of exchange rates can offer investors a competitive advantage in the global markets. Looking for gaps between the base currencies, for example, can provide opportunities to make profits from fluctuations in the foreign currency markets.

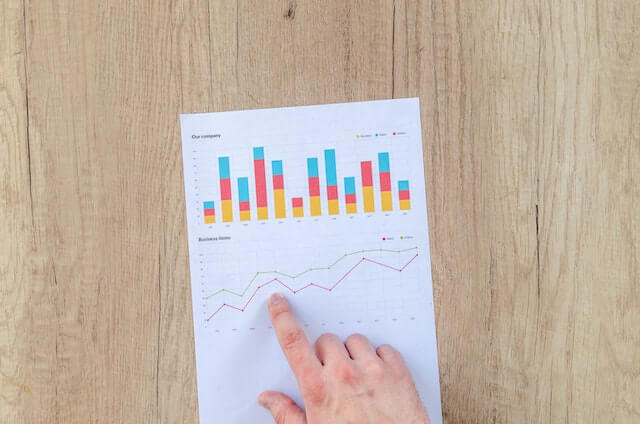

5.2 Track Your Profits

Keeping a close eye on investment performance and monitoring profitability is essential, especially in the case of exchange rate-based investments. Constant vigilance and careful calculation of forecasted gains are two key steps that can help investors maximize returns.

6 Expand Your Potential

Being able to think globally and make informed decisions can unlock the potential of international investments. When done right, global investing can bring increased rewards along with greater control over one’s financial destiny.

6.1 Think Global

Thinking globally means considering investments outside the traditional domestic market. When investing in global markets, investors need to consider a number of factors including the level of risk, the political landscape, and the economic climate of the country in which they are investing.

6.2 Diversify Your Options

Diversification is key when it comes to global investment. By diversifying across different countries, investors can reduce their exposure to risk. This can include investing in a variety of assets, and opening accounts in a variety of different countries.

7 Expand Your Influence

Taking control of one’s investments also brings enhanced influence over profits and assets. Taking a global approach to investments allows investors to open up new markets, diversify their portfolios, and stay ahead of changes in the marketplace.

7.1 Grab the Top Spot

As the global investing landscape evolves, investors need to constantly adjust their approach. Identifying trends, spotting new opportunities, and taking decisive action will keep one ahead of the competition and help to solidify top spot amongst other investors.

7.2 Ride the Wave

Understanding the markets and staying on top of investment opportunities is essential to maintain a competitive edge. Investors should ride the wave of change and have the courage to take advantage of emerging trends, while also taking a measured approach to managing risks.

8 Take Control

When investing globally, it is essential to take control of one’s investments. Automating investments and taking advantage of digital tools can help investors maintain an efficient approach to their strategy, while also maximising returns.

8.1 Automate Investments

Automating investments can help investors monitor their portfolio and make sure they are taking advantage of opportunities. This includes automated transfers of funds, and leveraging automated portfolio diversification options to help ensure optimal portfolio management.

8.2 Maximize Returns

Ultimately, the goal of global investment is to maximize returns on investments. Making sure to take advantage of market trends, diversify one’s portfolio, and exploit exchange rates can all be effective approaches to increase returns and ensure stability in both short and long-term investments.

According to Rani Jarkas, global investment opens up exciting new opportunities for investors, from gaining an edge on exchange rates to tapping into new markets. With informed advice and an understanding of their available options, investors can take control of their portfolio and unlock the power of global investments.

Leave a Reply

You must be logged in to post a comment.